Mastering the Adjusted Trial Balance Sheet: A Quick Guide

<!DOCTYPE html>

The adjusted trial balance sheet is a critical tool in accounting, ensuring accuracy in financial reporting. It reflects all adjustments made to the general ledger accounts, providing a clear picture of a company’s financial position before finalizing statements. Whether you’re a business owner, accountant, or student, mastering this document is essential for informed decision-making. (adjusted trial balance, financial reporting, accounting basics)

What is an Adjusted Trial Balance Sheet?

An adjusted trial balance sheet is a listing of all general ledger accounts after adjusting entries have been posted. It ensures that revenues and expenses are accurately matched to the correct accounting period, adhering to the matching principle. This sheet is a precursor to preparing financial statements like the income statement and balance sheet. (general ledger, matching principle, financial statements)

Why is the Adjusted Trial Balance Important?

The adjusted trial balance is crucial for:

- Ensuring accuracy in financial reporting.

- Identifying errors before finalizing statements.

- Complying with accounting standards like GAAP or IFRS.

Without it, financial statements may misrepresent a company’s financial health. (financial reporting, GAAP, IFRS)

Steps to Prepare an Adjusted Trial Balance Sheet

Step 1: Post Adjusting Entries

Record all adjusting entries, such as accruals, deferrals, and estimates, in the general ledger. These entries correct timing differences and ensure accurate reporting. (adjusting entries, accruals, deferrals)

Step 2: List All Accounts

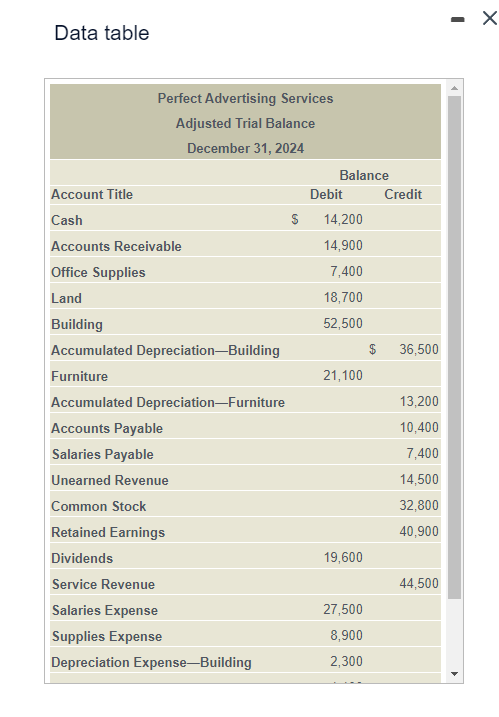

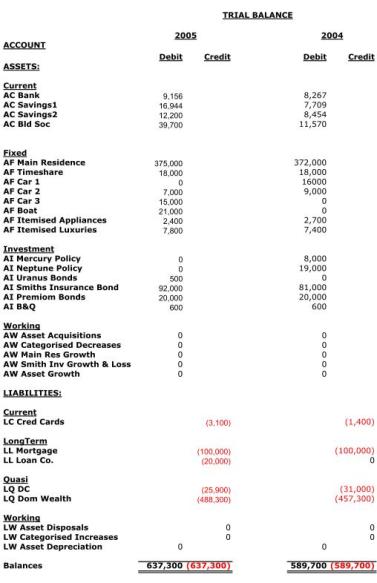

Compile a list of all general ledger accounts, including assets, liabilities, equity, revenues, and expenses. Ensure each account reflects the adjusted balance. (general ledger, assets, liabilities)

Step 3: Calculate Balances

For each account, calculate the adjusted debit and credit balances. Ensure the total debits equal total credits to confirm accuracy. (debit, credit, account balance)

📌 Note: Always double-check calculations to avoid discrepancies in the adjusted trial balance.

Step 4: Review for Errors

Scrutinize the sheet for any discrepancies or errors. Common issues include omitted entries, incorrect amounts, or mismatched totals. (error detection, financial accuracy)

Common Adjustments in the Trial Balance

Typical adjustments include:

| Adjustment Type | Purpose |

|---|---|

| Accrued Expenses | Record expenses incurred but not yet paid. |

| Prepaid Expenses | Allocate expenses paid in advance to the correct period. |

| Depreciation | Account for the wear and tear of assets over time. |

(accrued expenses, prepaid expenses, depreciation)

Checklist for Mastering the Adjusted Trial Balance

- Post all adjusting entries accurately.

- Verify debit and credit balances.

- Ensure totals are equal.

- Review for errors before finalizing.

(adjusting entries, debit, credit, error detection)

Mastering the adjusted trial balance sheet is key to accurate financial reporting. By following these steps and understanding its importance, you can ensure your financial statements are reliable and compliant. Whether for business or academic purposes, this skill is invaluable in the world of accounting. (financial reporting, accounting skills, business finance)

What is the purpose of an adjusted trial balance?

+The adjusted trial balance ensures all adjusting entries are recorded, providing an accurate basis for financial statements. (adjusted trial balance, financial statements)

How does it differ from an unadjusted trial balance?

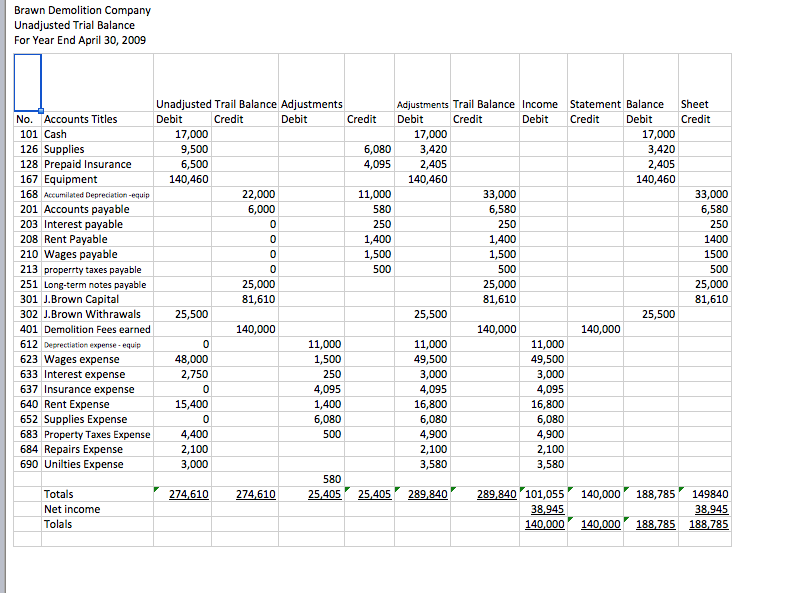

+An unadjusted trial balance lists accounts before adjustments, while the adjusted version includes all correcting entries. (unadjusted trial balance, adjusting entries)

Why do debits and credits need to match?

+Matching debits and credits ensures the accounting equation (Assets = Liabilities + Equity) remains balanced. (debit, credit, accounting equation)