Book vs. Market Value: Understanding the Key Differences

When it comes to valuing assets or investments, understanding the difference between book value and market value is crucial. While both metrics provide insights into an asset's worth, they are calculated differently and serve distinct purposes. This guide breaks down the key differences, helping you make informed financial decisions, whether you're an investor, business owner, or simply looking to understand these concepts better. (Asset Valuation, Financial Metrics, Investment Basics)

What is Book Value?

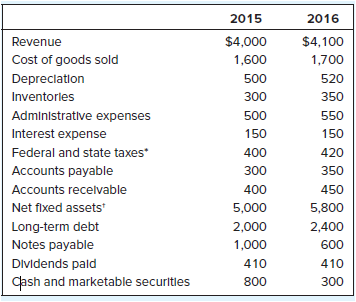

Book value represents the net value of an asset as recorded on a company's balance sheet. It is calculated by subtracting accumulated depreciation and liabilities from the asset's original cost. Book value is often used in accounting to reflect the historical cost of an asset. (Accounting Principles, Balance Sheet, Historical Cost)

Key Components of Book Value

- Original Cost: The initial purchase price of the asset.

- Accumulated Depreciation: The total depreciation expense recorded over the asset's life.

- Liabilities: Any debts or obligations associated with the asset.

For instance, if a company buys machinery for $50,000 and records $10,000 in depreciation, the book value would be $40,000. This figure provides a snapshot of the asset's value based on accounting records. (Depreciation, Asset Management, Financial Reporting)

What is Market Value?

Market value is the current price at which an asset can be bought or sold in the open market. It reflects what investors or buyers are willing to pay for the asset based on supply and demand dynamics. Market value is often higher or lower than book value due to factors like market sentiment, economic conditions, and future growth potential. (Market Dynamics, Investment Valuation, Supply and Demand)

Factors Influencing Market Value

- Market Sentiment: Investor perceptions and confidence in the asset.

- Economic Conditions: Broader economic trends affecting asset prices.

- Growth Potential: Expectations of future returns or appreciation.

For example, a piece of real estate might have a book value of $200,000 but a market value of $250,000 due to high demand in the area. This discrepancy highlights the difference between historical cost and current market conditions. (Real Estate Valuation, Market Trends, Asset Pricing)

Book Value vs. Market Value: A Comparative Table

| Criteria | Book Value | Market Value |

|---|---|---|

| Basis | Historical Cost | Current Market Price |

| Purpose | Accounting and Financial Reporting | Investment and Sale Decisions |

| Influencing Factors | Depreciation, Original Cost | Supply, Demand, Market Sentiment |

📌 Note: While book value is objective and based on accounting records, market value is subjective and influenced by external factors.

When to Use Book Value vs. Market Value

Understanding when to use book value or market value depends on your goals. Book value is ideal for internal accounting and assessing an asset's historical cost. Market value, on the other hand, is essential for investment decisions, mergers, and acquisitions. (Financial Analysis, Investment Strategies, Business Valuation)

Checklist: When to Use Each Metric

- Use book value for:

- Financial reporting

- Asset depreciation tracking

- Use market value for:

- Buying or selling assets

- Evaluating investment opportunities

In summary, book value and market value serve different purposes but are both essential in financial analysis. While book value provides a historical perspective, market value reflects current market conditions. By understanding these differences, you can make more informed decisions about asset valuation and investment. (Financial Decision-Making, Asset Valuation, Investment Basics)

What is the main difference between book value and market value?

+

Book value is based on historical cost and accounting records, while market value reflects the current price an asset can fetch in the market.

Why is market value often different from book value?

+

Market value is influenced by factors like supply and demand, market sentiment, and economic conditions, which can differ from the historical cost recorded in book value.

Which metric is better for investment decisions?

+

Market value is typically better for investment decisions as it reflects current market conditions and potential future returns.