Direct Price Variance: What It Means & How to Calculate It

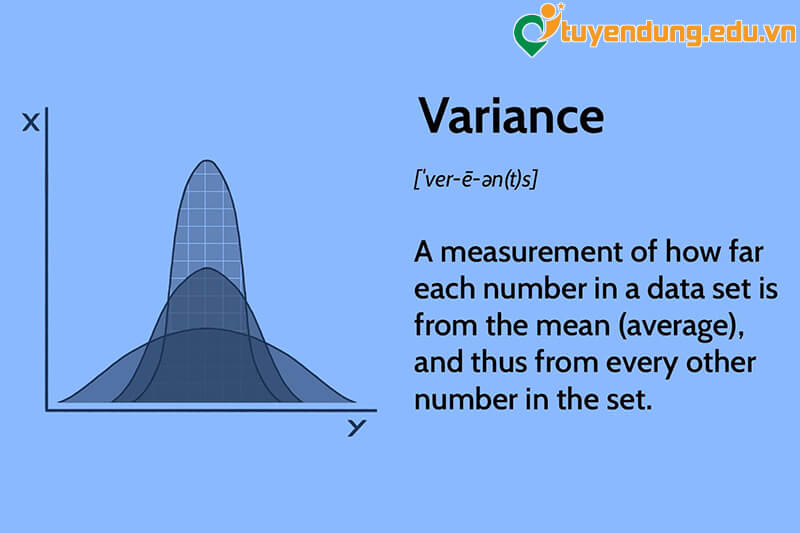

Understanding Direct Price Variance is crucial for businesses aiming to optimize their financial performance. It measures the difference between the actual cost of materials or goods and the standard cost, multiplied by the actual quantity used. This metric helps companies identify inefficiencies, control costs, and improve profitability. Whether you’re a business owner, accountant, or financial analyst, mastering this concept can provide valuable insights into your operations.

What is Direct Price Variance?

Direct Price Variance (DPV) is a financial metric used in cost accounting to analyze the difference between the actual price paid for materials or goods and the standard price, considering the actual quantity purchased. It highlights whether a company has spent more or less than expected on its direct materials.

📌 Note: Direct Price Variance focuses solely on price differences, not quantity variations. For quantity-related discrepancies, refer to Direct Quantity Variance.

Why is Direct Price Variance Important?

Monitoring DPV helps businesses:

- Identify cost overruns or savings.

- Evaluate supplier performance and negotiate better deals.

- Improve budgeting and forecasting accuracy.

- Enhance overall cost control strategies.

By understanding DPV, companies can make data-driven decisions to optimize their procurement processes and financial health.

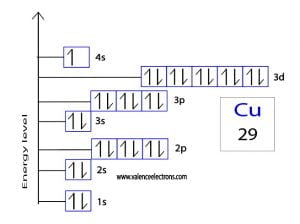

How to Calculate Direct Price Variance

The formula for Direct Price Variance is straightforward:

DPV = (Actual Price – Standard Price) × Actual Quantity

Here’s a step-by-step breakdown:

1. Determine the Actual Price: The price paid for materials or goods.

2. Identify the Standard Price: The expected or budgeted price per unit.

3. Calculate the Difference: Subtract the standard price from the actual price.

4. Multiply by Actual Quantity: Apply the price difference to the quantity purchased.

| Component | Description |

|---|---|

| Actual Price | The real cost paid per unit. |

| Standard Price | The expected cost per unit. |

| Actual Quantity | The number of units purchased. |

📌 Note: A positive DPV indicates higher spending than expected, while a negative value suggests cost savings.

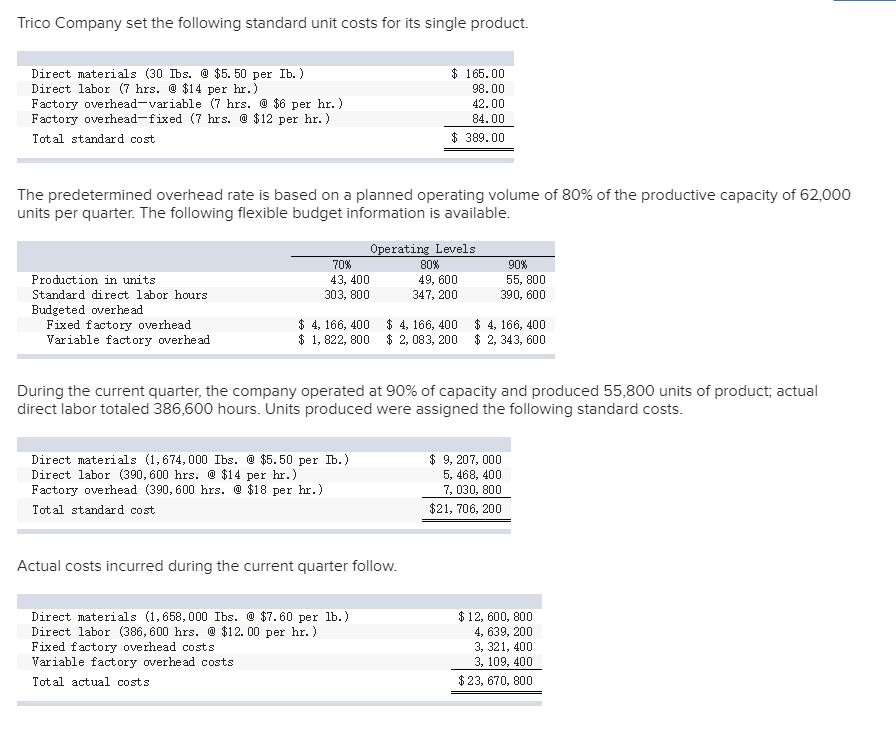

Example of Direct Price Variance Calculation

Suppose a company buys 1,000 units of raw material at 12 per unit, but the standard price is 10 per unit. The DPV would be:

DPV = (12 – 10) × 1,000 = $2,000

This result shows the company overspent by $2,000 on materials.

Key Factors Affecting Direct Price Variance

Several factors can influence DPV, including:

- Market Fluctuations: Changes in supply and demand affecting material prices.

- Supplier Negotiations: Discounts or price increases from suppliers.

- Quality of Materials: Higher-quality materials often come at a premium.

- Economic Conditions: Inflation or deflation impacting costs.

Understanding these factors helps businesses anticipate and manage DPV effectively.

Checklist for Managing Direct Price Variance

To effectively monitor and control DPV, follow these steps:

- Set Accurate Standard Prices: Regularly update benchmarks based on market trends.

- Negotiate with Suppliers: Secure favorable pricing agreements.

- Track Market Changes: Stay informed about price fluctuations.

- Review Procurement Processes: Identify inefficiencies and optimize buying strategies.

- Analyze Variance Reports: Use data to make informed decisions.

By implementing these practices, businesses can minimize adverse variances and maximize cost savings.

Wrapping Up

Direct Price Variance is a vital tool for assessing cost efficiency in procurement. By calculating and analyzing DPV, businesses can uncover opportunities to reduce expenses, improve supplier relationships, and enhance overall financial performance. Regular monitoring and strategic adjustments ensure long-term profitability and sustainability.

What causes Direct Price Variance?

+Direct Price Variance is caused by differences between the actual price paid for materials and the standard price, influenced by market fluctuations, supplier negotiations, and economic conditions.

How can businesses reduce Direct Price Variance?

+Businesses can reduce DPV by negotiating better supplier deals, setting accurate standard prices, and staying informed about market trends.

Is Direct Price Variance the same as Direct Quantity Variance?

+No, Direct Price Variance focuses on price differences, while Direct Quantity Variance deals with discrepancies in the quantity of materials used.

cost accounting,financial metrics,procurement strategies,cost control,supplier negotiations,budgeting,forecasting,market fluctuations,economic conditions,material costs.