Pasadena Social Security: Essential Benefits Guide

Understanding Pasadena Social Security benefits is crucial for residents looking to secure their financial future. Whether you’re nearing retirement, planning for disability coverage, or exploring survivor benefits, this guide provides essential information tailored to your needs. Pasadena residents can access various Social Security programs designed to offer financial stability during critical life stages. From eligibility criteria to application processes, this article breaks down everything you need to know to maximize your benefits effectively.

Pasadena Social Security Benefits Overview

Social Security in Pasadena offers a safety net for retirees, disabled individuals, and surviving family members. These benefits are funded through payroll taxes and provide monthly payments to eligible recipients. Understanding the types of benefits available is the first step toward securing your financial well-being.

Types of Social Security Benefits

- Retirement Benefits: Available to individuals aged 62 or older who have accumulated sufficient work credits.

- Disability Benefits: Provides financial assistance to those unable to work due to a qualifying disability.

- Survivor Benefits: Supports spouses, children, and dependent parents of deceased workers.

📌 Note: Eligibility requirements vary for each benefit type, so it’s essential to review the criteria carefully.

Eligibility Criteria for Pasadena Residents

To qualify for Social Security benefits in Pasadena, you must meet specific requirements based on your circumstances.

Retirement Benefits Eligibility

- Age: Must be at least 62 years old.

- Work Credits: Typically, 40 credits (equivalent to 10 years of work) are required.

Disability Benefits Eligibility

- Medical Condition: Must have a disability expected to last at least one year or result in death.

- Work History: Requirements vary based on age and work credits earned.

Survivor Benefits Eligibility

- Relationship: Available to spouses, children, and dependent parents of deceased workers.

- Work Credits: The deceased worker must have earned sufficient credits.

How to Apply for Social Security in Pasadena

Applying for Social Security benefits is a straightforward process, but preparation is key.

Steps to Apply

- Gather Documents: Collect proof of identity, work history, and medical records (if applying for disability).

- Choose Application Method: Apply online, by phone, or in person at a local Social Security office.

- Submit Application: Ensure all information is accurate to avoid delays.

📌 Note: Applying online is the fastest and most convenient method for most applicants.

Maximizing Your Social Security Benefits

Strategic planning can help you maximize your Social Security benefits in Pasadena.

Tips for Optimization

- Delay Retirement Benefits: Waiting until full retirement age (or beyond) increases monthly payments.

- Check Earnings Record: Ensure your work history is accurate to avoid underpayment.

- Explore Spousal Benefits: Non-working spouses may be eligible for benefits based on their partner’s record.

Common Mistakes to Avoid

Avoiding these pitfalls can ensure you receive the full benefits you’re entitled to.

Mistakes to Watch For

- Applying Too Early: Claiming benefits at 62 results in permanently reduced payments.

- Ignoring Tax Implications: Social Security benefits may be taxable depending on your income.

- Failing to Report Changes: Notify the Social Security Administration of any changes in income or marital status.

Helpful Checklist for Pasadena Residents

Use this checklist to navigate the Social Security process efficiently:

- [ ] Verify eligibility for the desired benefit type.

- [ ] Gather all necessary documents.

- [ ] Choose the most convenient application method.

- [ ] Review and optimize benefit strategies.

- [ ] Report any changes to the SSA promptly.

Navigating Social Security benefits in Pasadena doesn’t have to be overwhelming. By understanding eligibility criteria, applying correctly, and avoiding common mistakes, you can secure the financial support you need. Whether you’re planning for retirement, managing a disability, or seeking survivor benefits, this guide provides the essential steps to maximize your entitlements.

What is the minimum age to apply for Social Security retirement benefits?

+The minimum age to apply for Social Security retirement benefits is 62 years old.

Can I work while receiving Social Security disability benefits?

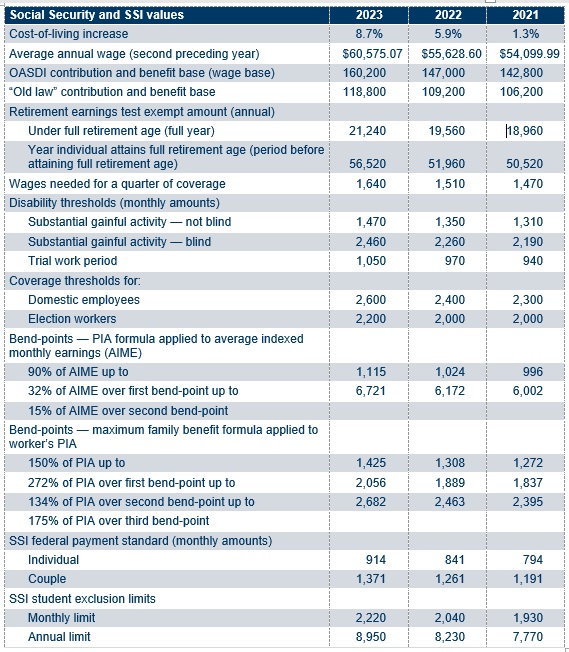

+Yes, but there are limits on how much you can earn. Exceeding these limits may affect your benefits.

How do I update my information with the Social Security Administration?

+You can update your information online, by phone, or in person at a local Social Security office.

Social Security Benefits,Retirement Planning,Disability Benefits,Survivor Benefits,Pasadena Social Security