Understanding Temporary Additional Duty: What You Need to Know

Understanding Temporary Additional Duty: What You Need to Know

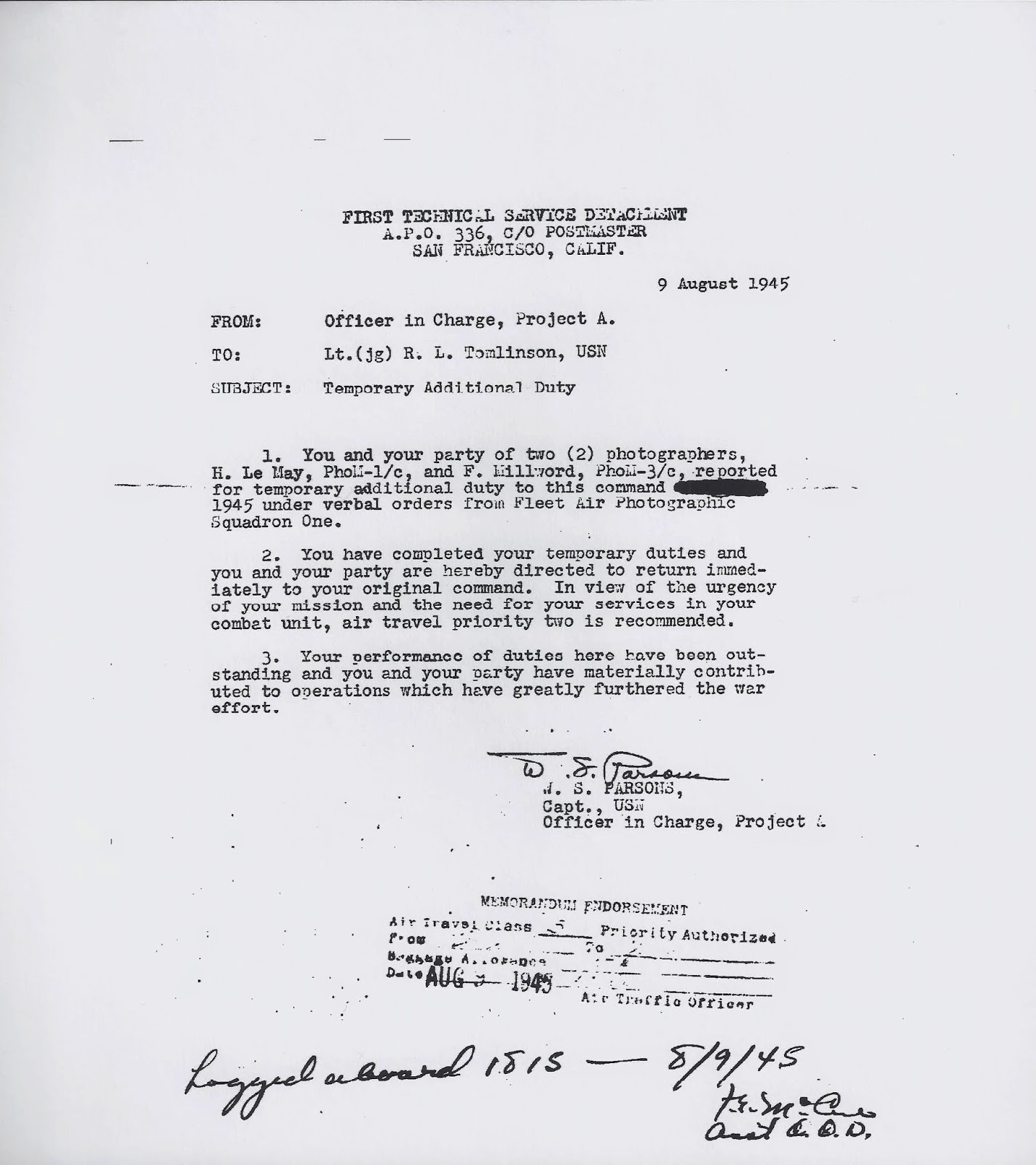

Temporary Additional Duty (TAD) is a term often encountered in various industries, particularly in customs and international trade. It refers to a temporary tax or duty imposed on imported goods, typically to protect domestic industries or regulate trade. For businesses and individuals involved in importing goods, understanding TAD is crucial to avoid unexpected costs and ensure compliance with regulations. This post will break down the essentials of TAD, its implications, and how to navigate it effectively.

What is Temporary Additional Duty (TAD)?

Temporary Additional Duty is a protective measure levied on imported goods to counteract unfair trade practices, such as dumping or subsidies. Unlike regular customs duties, TAD is imposed for a limited period and targets specific products or countries. Its primary goal is to level the playing field for domestic producers by making imported goods more expensive.

💡 Note: TAD is not a permanent duty and is subject to review and revision based on trade conditions.

Why is TAD Imposed?

TAD is typically imposed for the following reasons:

- Anti-Dumping Measures: To prevent foreign companies from selling products below market value, harming domestic industries.

- Countervailing Duties: To offset subsidies provided by foreign governments to their exporters.

- Safeguard Measures: To protect domestic industries from a sudden surge in imports.

How Does TAD Affect Importers?

For importers, TAD can significantly impact costs and profitability. Key considerations include:

- Increased Costs: TAD adds an extra layer of expense to imported goods, affecting pricing strategies.

- Compliance Requirements: Importers must ensure they accurately declare goods and pay the applicable TAD to avoid penalties.

- Market Dynamics: TAD can alter demand for imported goods, potentially benefiting domestic alternatives.

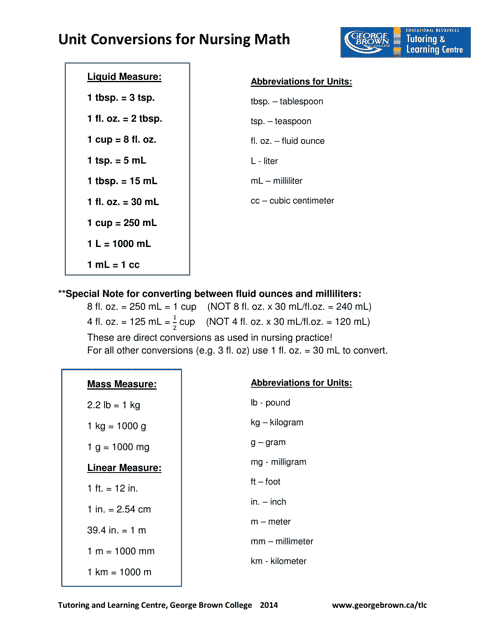

| Aspect | Impact of TAD |

|---|---|

| Cost | Increases import expenses |

| Compliance | Requires accurate reporting and payment |

| Market | Shifts demand toward domestic products |

How to Navigate TAD Effectively

To manage TAD efficiently, consider the following steps:

1. Stay Informed: Regularly check updates on TAD regulations and affected products.

2. Consult Experts: Work with customs brokers or trade consultants to ensure compliance.

3. Plan Ahead: Factor TAD into your budgeting and pricing strategies.

4. Explore Alternatives: Consider sourcing from countries not subject to TAD or using domestic suppliers.

Checklist for Managing TAD

- [ ] Research current TAD rates and applicable products.

- [ ] Verify compliance with customs regulations.

- [ ] Adjust import strategies to minimize costs.

- [ ] Monitor trade policy changes for future updates.

📌 Note: Regularly reviewing trade agreements and policies can help you stay ahead of TAD-related changes.

Wrapping Up

Temporary Additional Duty is a critical aspect of international trade that can impact importers significantly. By understanding its purpose, implications, and strategies to navigate it, businesses can mitigate risks and maintain profitability. Staying informed and proactive is key to managing TAD effectively.

What is the difference between TAD and regular customs duty?

+TAD is a temporary, protective duty imposed on specific goods, while regular customs duty is a standard tax on all imported goods.

How long does TAD typically last?

+TAD is usually imposed for a limited period, ranging from a few months to a few years, depending on trade conditions.

Can TAD be challenged or appealed?

+Yes, importers can challenge TAD through legal or administrative processes if they believe it is unjustified.

Related Keywords: Temporary Additional Duty, customs duty, anti-dumping, trade regulations, import costs, customs compliance.